Professional Mortgage Brokers Aiding You Protect the most effective Rates

Browsing the home mortgage landscape can be a complicated task, yet skilled home mortgage brokers are outfitted to streamline this procedure and safeguard one of the most desirable prices for their clients. Their comprehensive market understanding and strong lender relationships allow them to give customized options that line up with individual monetary circumstances. Nevertheless, recognizing the complexities of exactly how brokers run and determining the essential qualities that distinguish the finest from the remainder is important. As you consider your choices, it's crucial to explore what genuinely sets specialist brokers apart in this competitive atmosphere.

Benefits of Utilizing Mortgage Brokers

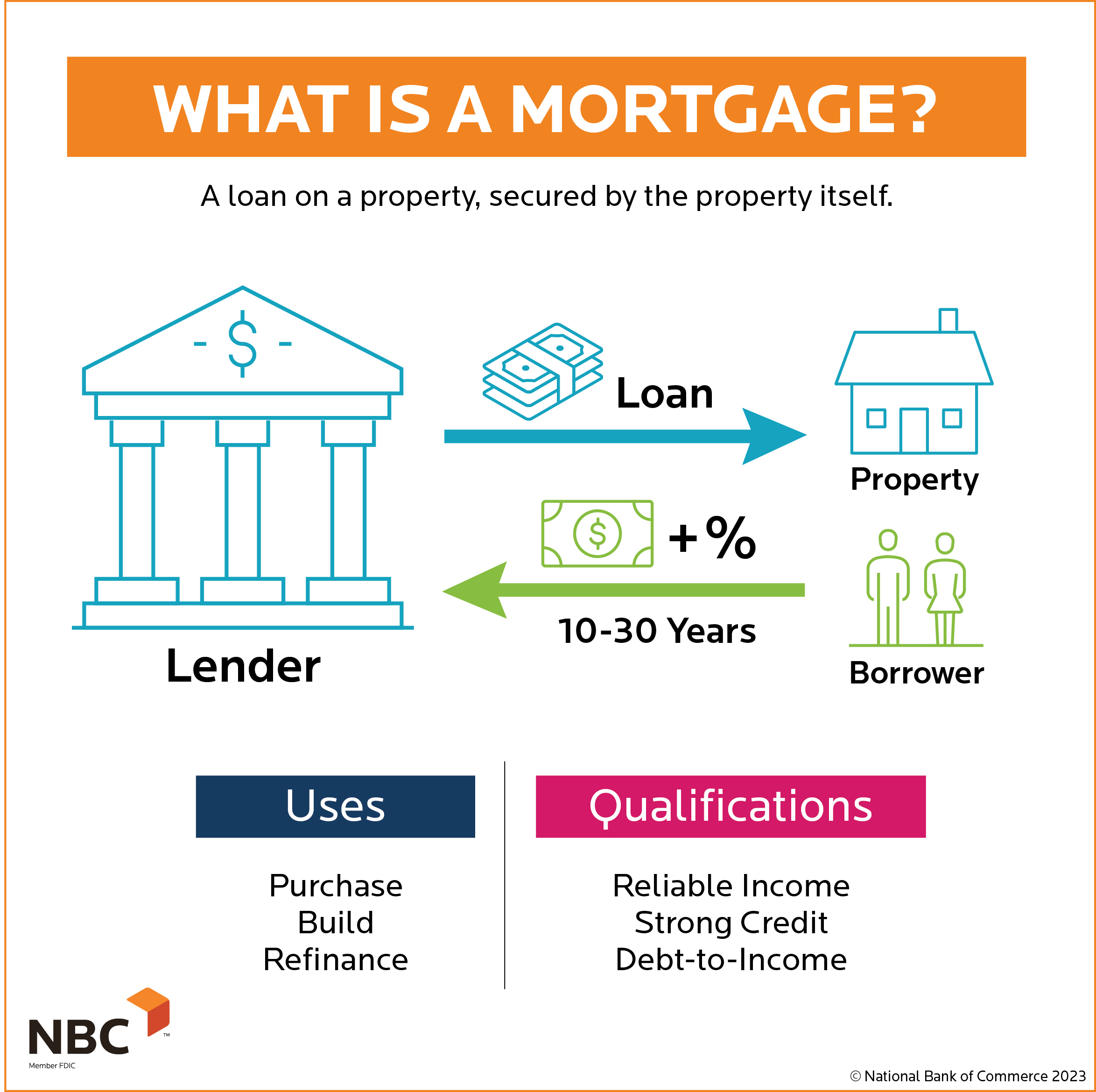

Why should buyers take into consideration using mortgage brokers in their search for the finest prices? Home mortgage brokers serve as useful intermediaries between lenders and debtors, supplying many advantages that can substantially boost the homebuying experience.

Furthermore, home loan brokers have thorough market understanding and competence, which can be specifically advantageous for novice homebuyers. They can give tailored advice customized to individual economic scenarios, aiding clients browse complicated home loan processes. Brokers commonly have developed connections with lenders, which may result in much better prices and terms than those readily available directly to borrowers.

An additional significant advantage is the time conserved throughout the home mortgage process. Brokers take care of much of the documents and interaction with lenders, permitting homebuyers to focus on various other aspects of their property search. In general, using a home mortgage broker can lead to much more desirable mortgage terms, a streamlined process, and notified decision-making for prospective homebuyers.

Exactly How Home Mortgage Brokers Work

Home mortgage brokers run as middlemans between lenders and consumers, assisting in the home loan application process. Brokers assess the economic circumstance of customers, consisting of earnings, credit report background, and general economic objectives.

Once a consumer chooses a favored alternative, brokers help in gathering necessary documentation and sending the mortgage application to the lender. They preserve interaction between all celebrations involved, making sure that updates are communicated without delay and that any type of questions or worries are resolved efficiently. Throughout the process, brokers leverage their expertise to work out desirable terms, striving to secure the very best rates for their customers.

Furthermore, home mortgage brokers stay informed regarding market trends and regulative modifications, which permits them to provide useful understandings and advice - Omaha Home Loans. By using their comprehensive network, brokers simplify the home mortgage procedure and enhance the chance of car loan authorization, ultimately saving debtors effort and time in achieving their homeownership goals

Secret Top Qualities of Professional Brokers

Effective home loan brokers possess a number of crucial top qualities that identify them in an affordable industry. Firstly, they demonstrate phenomenal interaction abilities. This capacity permits them to properly communicate complex monetary information to customers, making certain that debtors understand their options and the implications of their choices.

Furthermore, specialist brokers show strong analytical skills. They expertly examine clients' financial situations and market problems, enabling them to identify one of the most appropriate home mortgage products tailored to specific needs. A thorough understanding of the home loan landscape, including rates of interest, loan next provider demands, and funding alternatives, further boosts their efficiency.

Furthermore, successful brokers show a high degree of stability and credibility. Building enduring relationships with customers relies on openness and ethical practices, promoting self-confidence throughout the home mortgage procedure.

Additionally, a positive strategy is important. Expert brokers proactively look for the very best deals, frequently networking with loan providers to remain updated on brand-new offerings and adjustments out there.

Usual Blunders to Avoid

Browsing the home loan process can be daunting, and numerous debtors fall right into common catches that can impede their monetary goals. It's important to compare offers from multiple brokers to make certain affordable rates.

An additional mistake is not comprehending the complete price of the home loan, including costs and shutting prices. Numerous borrowers concentrate only on the rates of interest, ignoring these extra expenditures that can dramatically affect the overall loan amount.

Additionally, overlooking to check credit report prior to using can cause shocks. A bad credit report can affect the prices readily available, so it's important to evaluate go to the website your credit history record and deal with any problems in advance.

Finally, hurrying the decision-making procedure can result visit this website in regret. Take the time to research different home mortgage kinds and terms, guaranteeing you choose one that aligns with your monetary scenario. By preventing these typical errors, borrowers can position themselves for a smoother, a lot more effective mortgage experience.

Actions to Choose the Right Broker

Next, seek suggestions from close friends, family, or real estate professionals. Individual references provide valuable insights into a broker's track record and effectiveness. Furthermore, research online evaluations and endorsements to gauge client complete satisfaction.

When you have a shortlist, conduct interviews with potential brokers. Inquire about their communication style, accessibility, and the variety of mortgage products they use. A knowledgeable broker should have the ability to discuss complicated terms in a manner that is easy to comprehend.

Moreover, ask about their fee framework. Understanding how brokers are made up-- whether through commissions or level charges-- will certainly aid you examine their transparency and possible problems of passion.

Final Thought

In verdict, expert home loan brokers dramatically boost the possibility of protecting positive home loan rates and terms. By comprehending the nuances of the financial landscape and giving customized referrals, these brokers offer as vital allies for consumers.

Browsing the mortgage landscape can be a difficult job, yet experienced home mortgage brokers are equipped to simplify this process and secure the most favorable rates for their clients.Why should homebuyers consider using home loan brokers in their search for the finest rates? Generally, using a mortgage broker can lead to much more desirable home mortgage terms, a streamlined process, and informed decision-making for prospective property buyers.

Mortgage brokers operate as intermediaries between consumers and lending institutions, promoting the mortgage application procedure.In conclusion, expert home mortgage brokers dramatically boost the possibility of securing favorable home mortgage prices and terms.